Financial Literacy Scope and Sequence | Money Math for Special Education

Original price

$0.00

-

Original price

$0.00

Original price

$0.00

$0.00

-

$0.00

Current price

$0.00

Digital download

This is a digital download, no physical items will be sent to you. You will see the download as either a PDF or zip file.

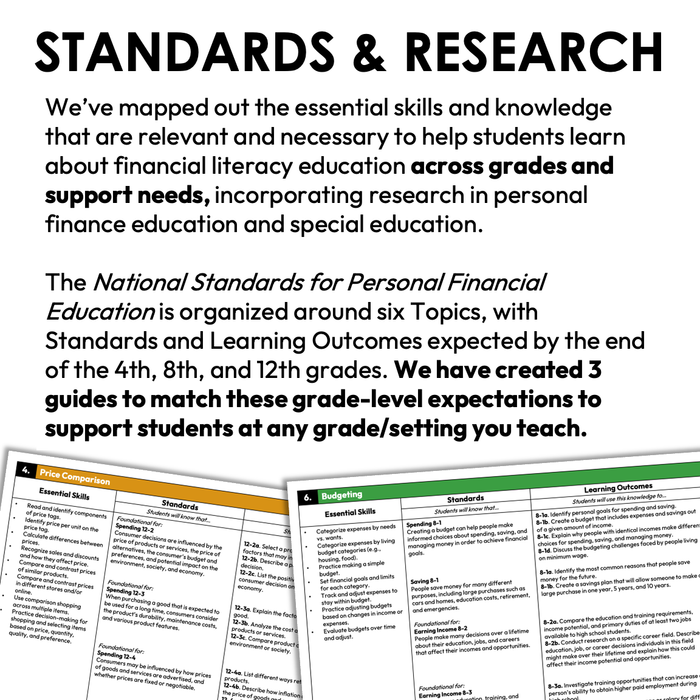

Financial literacy should be a priority across settings, and can be taught by general and special educators as well as in community-based settings. There are many topics, skill areas, practices, and interventions outlined in research on personal finance education and special education.

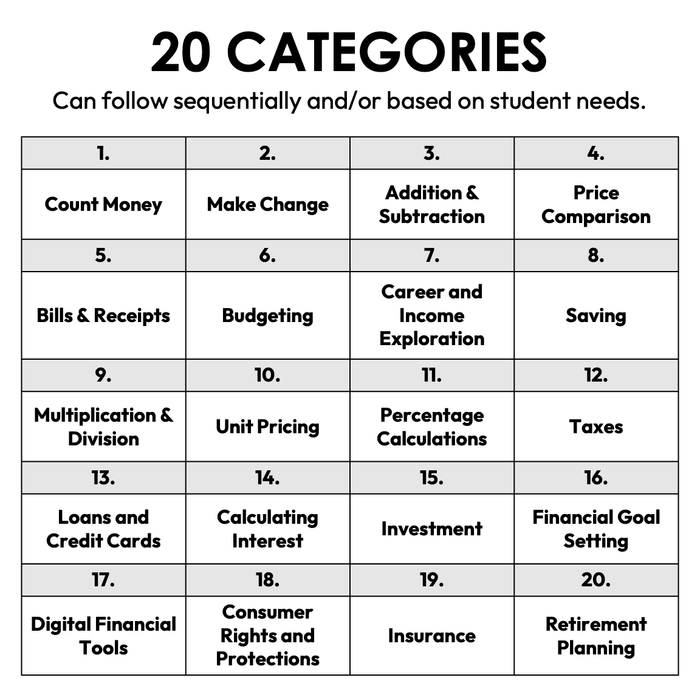

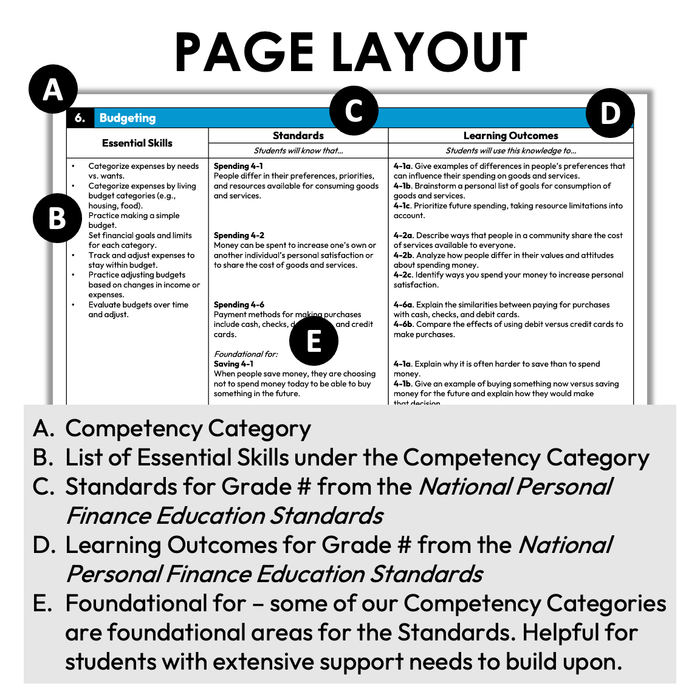

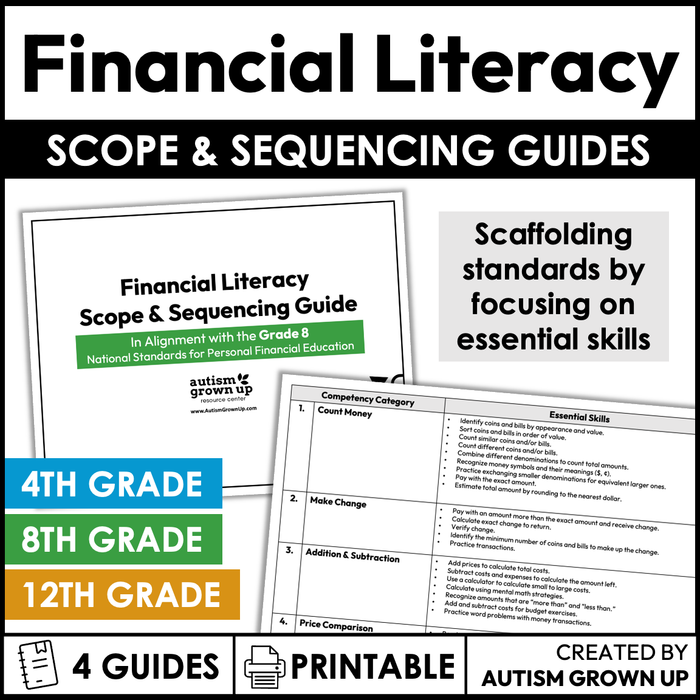

In these scope and sequencing guides, we have compiled 20 Competency Categories, each with their own set of Essential Skills.

The Competency Categories are:

-

Counting Money

-

Addition & Subtraction

-

Making Change

-

Price Comparison

-

Bills & Receipts

-

Budgeting

-

Saving

-

Multiplication & Division

-

Unit Pricing

-

Percentage Calculations

-

Loans and Debt

-

Calculating Interest

-

Career and Income Exploration

-

Taxes

-

Insurance

-

Investment

-

Financial Goal Setting

-

Consumer Rights and Protections

-

Digital Financial Tools

-

Retirement Planning

What's Inside:

-

Financial Literacy Scope & Sequencing Guide

-

By Grade 4 - Financial Literacy Scope & Sequencing Guide

-

By Grade 8 - Financial Literacy Scope & Sequencing Guide

-

By Grade 12 - Financial Literacy Scope & Sequencing Guide

The grade-level scope & sequencing guides are aligned with the Standards and Learner Outcomes from the National Standards for Personal Financial Education.

National Standards for Personal Financial Education

We have also aligned the guides with the National Standards for Personal Financial Education created by the Council for Economic Education (CEE) and the Jump$tart Coalition for Personal Financial Literacy (Jump$tart). You can read more about the National Standards for Personal Financial Education at www.jumpstart.org.

Organized around six topics (Earning Income, Spending, Saving, Investing, Managing Credit, Managing Risk) with Standards and Learning Outcomes expected by the end of the 4th, 8th, and 12th grades, or by the end of elementary, middle school, and high school, respectively. The topics build upon each other and grow more complex by the end of each grade level.

You can email us at hello@autismgrownup.com if you have any feedback, questions, and/or requests for resources.